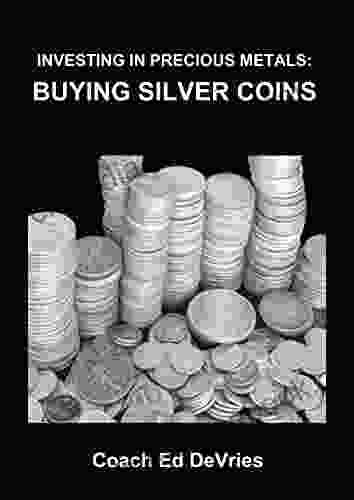

Savers Do Not Have To Be Losers Investing In Gold, Silver, and Precious Metals

In a world where inflation is eroding the value of fiat currencies, savers are increasingly looking for alternative investments to protect their wealth. Gold, silver, and other precious metals have long been considered a safe haven during periods of economic uncertainty, and for good reason. These precious metals have intrinsic value, are not subject to the same inflationary pressures as fiat currencies, and have a long history of outperforming other investments during times of crisis.

However, investing in gold, silver, and precious metals is not without its risks. These precious metals can be volatile, and their prices can fluctuate significantly in the short term. It is important to do your research and understand the risks involved before investing in these assets.

4.3 out of 5

| Language | : | English |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Lending | : | Enabled |

| File size | : | 9390 KB |

| Screen Reader | : | Supported |

| Print length | : | 36 pages |

The Benefits of Investing in Gold, Silver, and Precious Metals

There are many benefits to investing in gold, silver, and precious metals. These benefits include:

- Intrinsic value: Gold, silver, and other precious metals have intrinsic value, meaning that they are worth something regardless of their market price. This is in contrast to fiat currencies, which are only worth what the government says they are worth.

- Inflation hedge: Gold, silver, and other precious metals have a long history of outperforming fiat currencies during periods of inflation. This is because these precious metals are not subject to the same inflationary pressures as fiat currencies.

- Safe haven: Gold, silver, and other precious metals are often seen as a safe haven during periods of economic uncertainty. This is because these precious metals are considered to be a store of value and a hedge against inflation.

- Diversification: Gold, silver, and other precious metals can help to diversify your investment portfolio. This is because these precious metals are not correlated to other asset classes, such as stocks and bonds.

The Risks of Investing in Gold, Silver, and Precious Metals

There are also some risks associated with investing in gold, silver, and precious metals. These risks include:

- Volatility: Gold, silver, and other precious metals can be volatile, and their prices can fluctuate significantly in the short term. This volatility can make it difficult to time your investments and can lead to losses if you are not careful.

- Storage costs: Gold, silver, and other precious metals can be expensive to store. If you do not have a safe place to store these precious metals, you may need to pay for storage fees.

- Liquidity: Gold, silver, and other precious metals can be less liquid than other investments, such as stocks and bonds. This means that it may be difficult to sell these precious metals quickly if you need to raise cash.

How to Invest in Gold, Silver, and Precious Metals

There are several ways to invest in gold, silver, and other precious metals. These methods include:

- Physical bullion: Physical bullion is the most direct way to invest in gold, silver, and other precious metals. Physical bullion can be purchased in the form of coins, bars, or rounds. Physical bullion is a good option for investors who want to take physical possession of their precious metals.

- Exchange-traded funds (ETFs): ETFs are a type of investment fund that tracks the price of gold, silver, or other precious metals. ETFs are a good option for investors who want to gain exposure to precious metals without having to take physical possession of them.

- Mining stocks: Mining stocks are stocks of companies that mine gold, silver, or other precious metals. Mining stocks can be a good option for investors who want to gain exposure to precious metals through the stock market.

Which precious metal is right for me?

The best precious metal for you will depend on your individual investment goals and risk tolerance. If you are looking for a safe haven asset that is likely to hold its value during periods of economic uncertainty, gold is a good option. If you are looking for a more volatile precious metal with the potential for higher returns, silver may be a better option.

No matter which precious metal you choose to invest in, it is important to do your research and understand the risks involved. Precious metals can be a valuable addition to a diversified investment portfolio, but they are not without their risks.

Forbes

The Federal Reserve has been raising interest rates in an effort to combat inflation. This has led to a decline in the prices of gold, silver, and other precious metals. However, some experts believe that this decline is temporary and that precious metals are still a good investment.

"Precious metals have been a safe haven asset for centuries," said William Pesce, a precious metals expert. "They are a good investment during periods of economic uncertainty."

Pesce recommends that investors allocate 5% to 10% of their portfolio to precious metals. He also recommends that investors buy physical bullion, rather than ETFs or mining stocks.

"Physical bullion is the most direct way to invest in precious metals," Pesce said. "It is also the safest way to invest, because you have physical possession of your metal."

If you are considering investing in precious metals, it is important to do your research and understand the risks involved. Precious metals can be a volatile investment, and their prices can fluctuate significantly. However, if you are looking for a safe haven asset that is likely to hold its value during periods of economic uncertainty, precious metals are a good option.

4.3 out of 5

| Language | : | English |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Lending | : | Enabled |

| File size | : | 9390 KB |

| Screen Reader | : | Supported |

| Print length | : | 36 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Darrin Lowery

Darrin Lowery Radha Chadha

Radha Chadha Katheryn Russell Brown

Katheryn Russell Brown Mark Phillips

Mark Phillips Alfredo Toro Hardy

Alfredo Toro Hardy Sonja Linden

Sonja Linden John Mauk

John Mauk Souchou Yao

Souchou Yao Rob Cowen

Rob Cowen Norm Champ

Norm Champ T J Mcintosh

T J Mcintosh Michael Meyer

Michael Meyer Donna Alward

Donna Alward Laura Marie Altom

Laura Marie Altom Arthur C Brooks

Arthur C Brooks K C Lannon

K C Lannon Alfred De Vigny

Alfred De Vigny Robert J Sternberg

Robert J Sternberg Barbara Berezowski

Barbara Berezowski James Beard

James Beard

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Terry PratchettWar in the West: Border Knight 10—A Comprehensive Guide to the Landmark...

Terry PratchettWar in the West: Border Knight 10—A Comprehensive Guide to the Landmark...

Edgar HayesBlood of Tyrants: A Captivating Novel of Aerial Warfare and Intrigue in the...

Edgar HayesBlood of Tyrants: A Captivating Novel of Aerial Warfare and Intrigue in the...

Austin FordThe Tenderfoot: A Timeless Western Adventure That Captures the True Spirit of...

Austin FordThe Tenderfoot: A Timeless Western Adventure That Captures the True Spirit of...

Dwight BellA Comprehensive Guide to Cultivating the Family Enterprise: Nurturing Legacy,...

Dwight BellA Comprehensive Guide to Cultivating the Family Enterprise: Nurturing Legacy,... Aubrey BlairFollow ·18.9k

Aubrey BlairFollow ·18.9k Eli BlairFollow ·4k

Eli BlairFollow ·4k Greg CoxFollow ·19k

Greg CoxFollow ·19k Graham BlairFollow ·4.4k

Graham BlairFollow ·4.4k Roberto BolañoFollow ·18.4k

Roberto BolañoFollow ·18.4k Elliott CarterFollow ·4.1k

Elliott CarterFollow ·4.1k Bob CooperFollow ·7.2k

Bob CooperFollow ·7.2k Harrison BlairFollow ·6.3k

Harrison BlairFollow ·6.3k

Fabian Mitchell

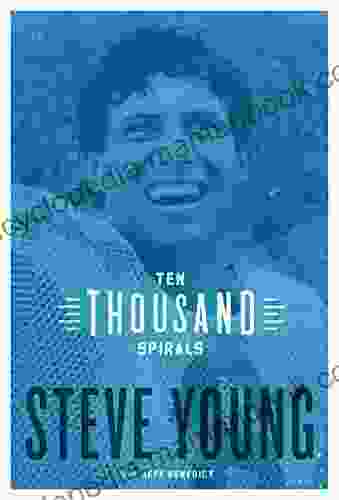

Fabian MitchellTen Thousand Spirals: Leccion Inagural Del Curso...

Ten Thousand...

Howard Blair

Howard BlairThe Captivating Collection of High School Romance Poetry

Love's First...

4.3 out of 5

| Language | : | English |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Lending | : | Enabled |

| File size | : | 9390 KB |

| Screen Reader | : | Supported |

| Print length | : | 36 pages |